THE ROLE OF FINANCIAL MANAGEMENT IN STARTUPS

Control or chaos? The crucial role of financial management in startups

Learn how to successfully implement finance in your early stage startup

A few days ago I was lucky to be with José Antonio González, partner at Deloitte, and we talked about the role of finance in an early stage startup.

He told me: “Finance is the invisible keel of our company, essential but not always visible. Just as a ship needs a solid keel to sail effectively, a company needs robust finances to move at full speed. They aren’t the main focus, just as the keel is not the star compared to the sails or the captain, but they are essential to steer us towards success. The keel doesn’t stop you from going bankrupt sometimes, if the ship is poorly managed, but it is necessary to sail and to function”.

When do we really start to take control of our startup?

You will have control of your startup when you start making strategic decisions based on data that have a direct impact on the business. Less “believe” and more reality, but never forgetting the importance of instinct.

Usually, the development of an early stage startup is seen as a roller coaster of emotions created under a mix of growth actions, new product features and very few hours of sleep. In addition, measuring unit economics and controlling cash flows is often overlooked. If this already represents you, this article might be for you!

After talking to founders of more than 100 closed startups, CB Insights published an article where they explained the main reasons why startups tend to flounder. The two main ones could be foreseen, monitored and measured quickly enough to mitigate risk and pivot if necessary.

A solid financial structure in your startup with a good set of unit economics metrics will allow you to know first-hand the reality and health of your business. This way, you will see if your project is financially viable or if you need to make adjustments to the model before it is too late. To do this, we will analyse how we can build and measure, because as Peter Ducker says: “What cannot be measured cannot be managed”.

In other words… If you want to create a successful startup you have to control your business. We have already mentioned the importance of measuring and imagine the positive impact it can have on the startup. So, shall we move on to action?

How do I build a correct measurement system? What framework do I use?

A good measurement system is one that allows you to visualise the quantities in your business, the financial results and finally the so-called value metrics, where all of them together allow you to understand the health of the business. The big secret of this is to start monitoring in the simplest possible way, generate the habit in your company and then, little by little, complicate the models to start making the best possible decisions.

Reconstructing the past

Reconstructing the past is an essential activity to understand the functioning of your business, as it allows you to understand a myriad of company characteristics through historical data. Here I only illustrate some basic ones that are important to know. For example, how it is impacted by seasonality, what is the behaviour of customers, how is the acquisition and retention of the company and, above all, how is the cash flow of the company in order to understand what is the monthly burn rate of your organisation.

Quantity

A fundamental part of our startup is to know the quantities it is involved in. For example, how many new customers have you acquired this month, how many have purchased through the marketplace or how many have cancelled their subscription. Basically, it is all the business units that allow us to understand the direction and magnitude of our company. Below you can see an example.

Imagining a subscription model

| Quantity | Month 1 | Month 2 | Month 3 |

|---|---|---|---|

| New customers | 5 | 6 | 10 |

| Churn customers | 0 | -1 | -2 |

| Total active customers | 5 | 10 | 18 |

With this simple analysis we can already know that our startup has a growing trend in terms of the final number of customers and a churn rate that we should pay attention to in order to boost our retention.

This information can often be obtained, even automatically, from the same payment gateways or where we manage subscription accounts, such as Shopify, Stripe or in apps with RevenueCat, among many other options for analytics control.

Profit and loss

To follow our analysis and given the complexity that for some people financial terms and concepts can mean, we are going to separate the reading into “easy mode” and “hardcore mode”. In this way, we will all speak the same language and I will give you some tips on how to do this in the simplest and most useful way possible.

P&L (easy mode)

After analysing variations in numbers, such as an increase in customers or fluctuations in sales, we can see a direct impact on our P&L. This is because such variations can lead to an increase in revenue, an increase in costs or even stock problems if sales exceed our expectations in a particular month.

Our P&L analysis should be done in the most professional way possible, connecting it to the company’s accounting. Of course, as we are at an early stage and probably don’t yet have a dedicated CFO or someone with a relative affinity for numbers, we can start the exercise by writing down in Excel ALL INCOME AND EXPENDITURE, structuring it in the following way WITHOUT VAT with a follow-up flow ideally weekly and a monthly closure.ç

Simple P&L example

| P&L | Month 1 | Month 2 | Month 3 |

|---|---|---|---|

| Revenue | 500 € | 1.000 € | 1.800 € |

| Costs | -50 € | -100 € | -180 € |

| Margin | 450 € | 900 € | 1.620 € |

| Wages | -2.500 € | -2.500 € | -2.500 € |

| Marketing | -1.000 € | -1.500 € | -2.000 € |

| Structure | -500 € | -600 € | -700 € |

| Total expenditure | -4.000 € | -4.600 € | -5.200 € |

| Ebitda | -3.550 € | -3.700 € | -3.580 € |

With this simple analysis we know whether the company is making or losing money. Although it is not the exact number, because we are missing some data that we will see later, it allows us to measure with 90% or 95% confidence what magnitude of cash (excluding VAT) we are burning or generating.

Cash flow (easy mode)

We have already managed to find out whether the company is losing or making money, but the goal now is to understand what the cash flows look like. The best and simplest way to understand this is to download the company’s daily bank movements for a given period, transfer them to Excel and categorise all inflows as “revenues” and all outflows as “expenses” to get something like this.

| Concept | Month 1 | Month 2 | Month 3 |

|---|---|---|---|

| Revenue | 500 € | 1.000 € | 1.800 € |

| Expenditure | -4.450 € | -3.800 € | -5.200 € |

| Cash flow | -3.550 € | -3.700 € | -3.580 € |

| Bank start month | 30.000 € | 26.450 € | 22.750 € |

| Bank end of month | 26.450 € | 22.750 € | 19.170 € |

And even if this is still too complicated, there are already startups and people dedicated to making life even simpler to understand the company’s treasury, such as Carlos Pérez and David Álvarez, co-founders of Banktrack.

If we are able to build a model, however simple it may be, where we can know how much money the company burns or earns per month, we will already have a more than decent control.

I don’t know how much of the money in my account is really mine!

Entrepreneurs sometimes find difficulties determining how much money in their bank account actually belongs to them. This problem happens mainly in those businesses where they are charged before the expense is incurred. For example, in a travel agency where the service is paid for before the airline ticket is purchased.

If you are faced with this situation, there is a simple and practical solution that you can implement at an early stage of your startup. Although it is not advisable to keep it for the long term, it can be useful while you are adjusting the company’s accounting.

The idea is to open a second bank account for your business. When you make a sale, you can calculate how much of that money does not belong to you (based on your gross margin) and transfer that amount to the second account. This way, that money is “reserved” for when you need to make the corresponding expenditure.

In the meantime, the money you generate and the money you get from capital increases is kept in the main account. This system will give you a clearer picture of how much money you are actually entitled to.

P&L (hardcore mode)

In order to build our P&L in the most correct way possible, we will have to work closely with our accounting team or the corresponding accountancy firm to have the accounting books as tidy as possible. A task worthy of recognition to those who we can call the “bookkeepers”.

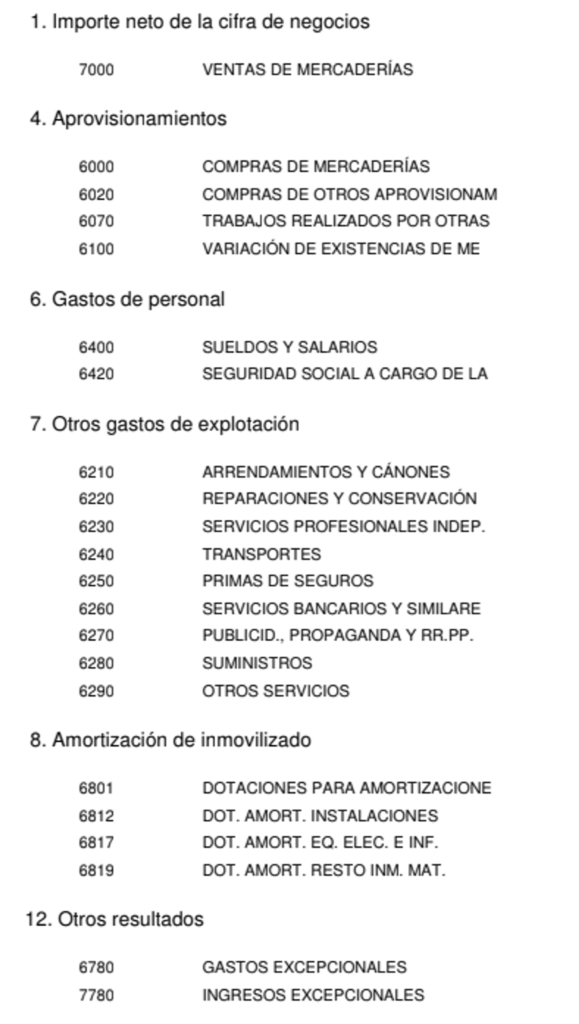

In order to obtain a P&L that is simple to read and organised, we should not send the invoices and let someone else take care of it. We must build the accounting structure based on the accounting accounts established under the General Accounting Plan standard. The aim is to be able to download a report from the accounts that can be interpreted. SOMETHING LIKE THAT.

If you are not an expert in finance and this complicates things a lot, there are startups that solve this or do it in a friendly way, such as Holded, run by Bernat Ripoll and Javi Fondevila. They are connected to specialised management companies that will allow you to keep a simpler and more direct report.

Cash flow (hardcore mode)

We have managed to establish a coherent and well-structured P&L through a specialised platform and with the support of a management team. Now, we face the additional challenge of controlling the cash flow through the P&L. As we know, there are often circumstances such as delays in customer payments, advances requested by suppliers, taxes, capital raisings and other activities that are not reflected solely in the P&L. Therefore, in order to build or rebuild our cash flow, we need to be aware of these items and know the corresponding amounts.

Some criteria to keep in mind are:

- Effect of VAT (output and input)

- VAT refund (if applicable)

- Deferred taxes that will then be paid quarterly, such as personal income tax.

- Accounts X payable

- Accounts X receivable

- Monetary contributions

- Taxes

As with accounting, we have platforms dedicated to treasury control, such as Agicap, from Sebastein Beyet. These allow you to connect with other tools to automate tasks, to have control of the information and also to project it.

Very good! We already have the quantities, the accounting and the treasury of our business. Now, let’s move on to the measurement of health…

Value metrics

It is one thing to know whether my company is making or losing money and whether I have money in the bank or not, but it is almost as important to be able to understand the reality of the business according to a set of metrics that allow me to demonstrate whether my project really has a future economic viability.

As we discussed with Barbara Marlet, CMO at Fractional, during a working session with entrepreneurs, they should not be guided by vanity metrics, such as visits to a website or likes on a photo, but by those that really have an impact on their business and that allow them to project the future results of the organisation.

Each company is extremely different and it is the duty of the founders to be able to recognise which metrics they should follow to monitor the viability of the business. Without going into too much detail, because there are already several reports on what the metrics are for each business, here are the ones that in my opinion are the ones that everyone should measure in one way or another in their company. Here is a list where you can find the necessary metrics for each type of company.

Metrics

- Customer acquisition metrics:

- Cost per acquisition (CPA)

- CPA payback

- Customer Lifetime Value (CLV)

- Lead-to-customer conversion rate

- Customer retention metrics:

- Customer churn rate

- Customer retention rate

- Average Order Value (AOV)

- Financial metrics:

- Monthly Recurring Revenue (MRR)

- Annual Recurring Revenue (ARR)

- Gross margin

- Average ticket

- User engagement metrics:

- Monthly Active Users (MAU)

- Number of daily active users (DAU)

- Average time on the application or website

- Operational metrics:

- Customer lifecycle

- Average time to close a sale

- Sales funnel conversion rate

Of all these metrics, the most important to know if our business is viable would be the LTV/CAC ratio, in which any X3 result starts to be very interesting. As a reference, an average SaaS in the US can have an X4 and in LATAM an X9 or more, according to State of Saas LatAm.

The calculation of these metrics can be defined as follows:

LTV: (average user spend * margin) / churn rate.

In an e-commerce type company that does not have a churn rate, the LTV can be measured by knowing the purchasing behaviour of customers by cohort and counting the amount of revenue * margin that they have left us since their entry during a year and calculating more or less the value that each of them leave us annually.

CAC: this is represented as all the company’s total costs dedicated to customer acquisition / total number of new customers.

If the result of this data is greater than X4, then our company is on the right track.

Well, entrepreneurs! We have arrived at the end of this article and I hope it has helped you to understand the importance of financial control and to discover some ideas on how to manage this in a simpler way. If you want to contact us, please do so through this link.

See you in a new article!